P2P INSURANCE POWERED BY DISTRIBUTED GOVERNANCE

WHAT IS P2P INSURANCE?

Over years, insurance industry has transformed from a communitydriven risk sharing model into an adversarial model where large institutions dominate the industry.

The return on investments of such institutions often goes into managing the increasing frictional costs of running a centralized business or distributing dividends to the stakeholders – seldom does the return on investments reach the policy holders.

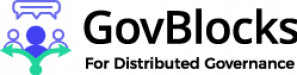

Traditional Insurance Model

Centralization, in any business model, comes with its own set of challenges like misaligned interests among stakeholders and lack of transparency. In the insurance industry, lack of cooperation within intermediaries results in significant frictional costs whereby about 35% of premium cost is often apportioned to operational expenses

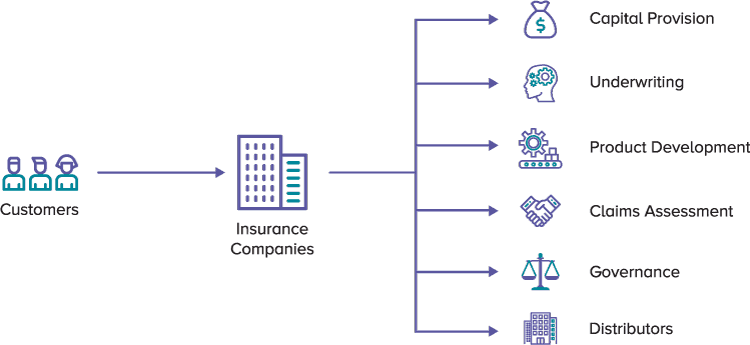

With the advent of blockchain, the new global infrastructure that facilitates disintermediation and decentralisation, there’s an opportunity to build true peer to peer risk sharing economies at scale, such that people are able to trust other people without knowing each other. P2P Insurance, powered by blockchain, allows a community to administer policies, buy insurance, assess claims, underwrite risk all among the members of a community.

P2P Insurance Model

CUSTOMER CASE STUDY

“GovBlocks affords us a modular approach to governance that can be easily changed if necessary. We can tweak voting weights, rewards, quorum levels, virtually all components of the governance process…

GovBlocks actually enables us to deliver on our goal of building a living breathing organism that can be fully controlled by its members”

Hugh Karp

Founder, Nexus Mutual

Context:

Nexus Mutual is building a decentralised alternative to Insurance which will entrust upon the members of Nexus Mutual a crucial role in governing the operations of the mutual.

The Challenges:

- ensure high and active member participation

- allow for upgradability in smart contracts

- minimise any centralisation within the mutual

How GovBlocks helped:

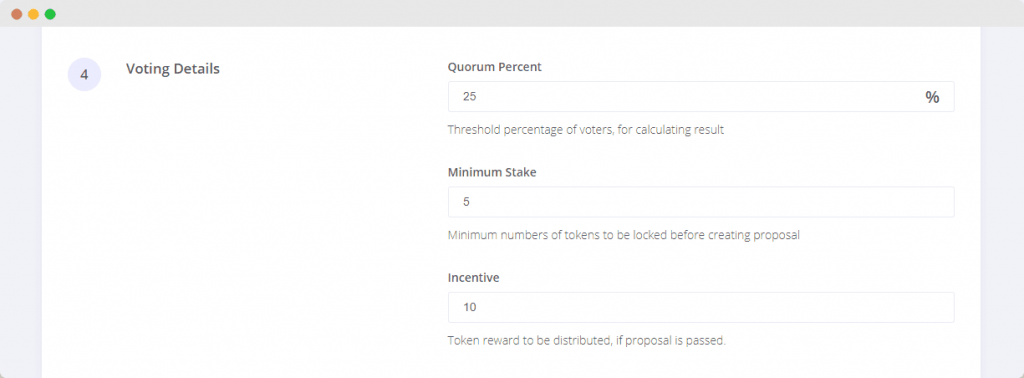

- to promote active member participation in decision making, Nexus Mutual configured GovBlocks to allow token rewards for voting

- to achieve upgradability, each decision point was made configurable and could be altered depending on the needs of the community

- to reduce the elements of centralised power sitting with the board, any member was allowed to raise a proposal to replace an advisory board member

INDUSTRY SPEAK

“I have been watching the development of this (GovBlocks) solution with great interest. Ish and his team are proving themselves to be both innovative and determined – a terrific combination! I wish them more on-going successes.”

Callum Holmes

ICT Advisor to the Bank of

Papua New Guinea

![]()

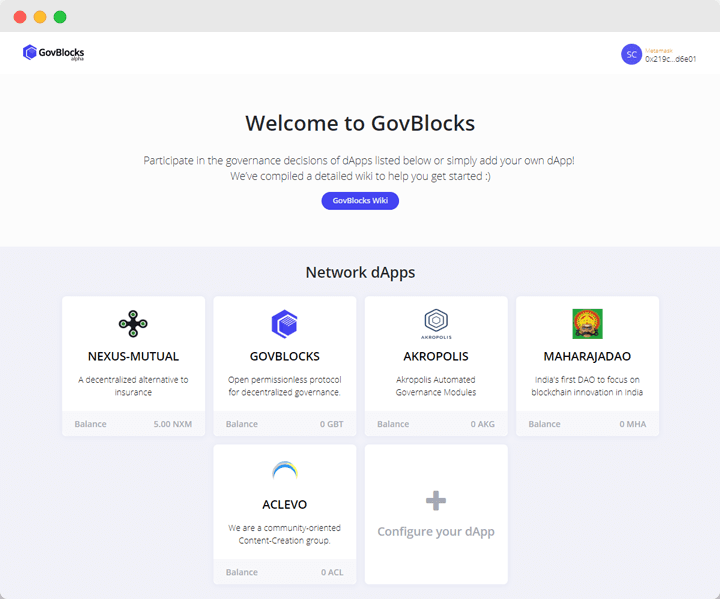

LAUNCH P2P INSURANCE WITH GOVBLOCKS

- Create a consortia, an insurance mutual, or any membershipdriven risk sharing community in the form of a new or existing network

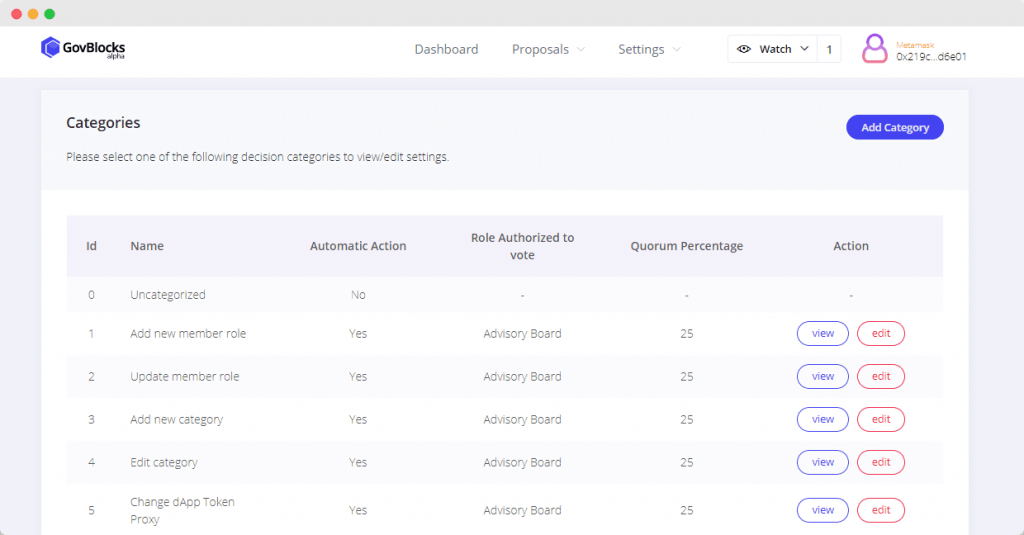

- Define member roles, decision points and the degree of decentralisation you wish to achieve to manage the mutual

- Configure insurance processes and workflows. Adopt a boardroom style approval process or experiment with futarchy!

![]()

LEVERAGE INCENTIVISED DECISION MAKING

-

Configure incentives for your community to take hollistic decisions on key insurance processes such as:

- Policy Administration

- Underwriting

- Claims Assessment

- Capital Management

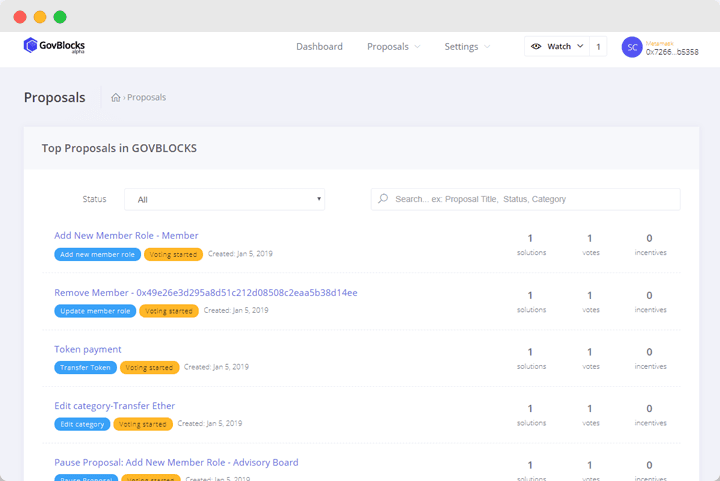

- Members are able to map and configure individual processes to incentivised decision points

- Audit data trails and resolve conflicts / disputes by setting up configurable arbitration policies

- Incentives can be distributed in the form of enhanced reputation and also financial gains based on a member’s participation in decision making

![]()

MAINTAIN IMMUTABLE, AUDITABLE TRACE

- Choose from a public or permissioned implementation on Ethereum, POA Network or Hyperledger Blockchain

- Audit data trails and resolve conflicts / disputes by setting up configurable arbitration policies

- Leverage battle tested pre-configured smart contracts to kick start your mutual

KEY FEATURES

Enables frictional cost and time saving

GovBlocks allows for more effective interactions between all partner intermediaries who become network stakeholders

Allows for distributed governance

GovBlock provides an enhanced and dynamic governance layer which is capable of managing a varied and constantly growing member structure

Provides a modular, configurable approach

Deploy a model that best suits your mutual community for defining members roles, vote count mechanism, etc. for each insurance process

Incentivises decision making

Configuring aligned incentives drive cooperation within the community and allows for increased interaction within members of the network